Electronic Checks & ACH Processing

According to the Federal Reserve, checks and automated clearing house processing (ACH) still make up a good portion of non-cash payments. ACH processing, especially online ACH processing, is even gaining in popularity because it's easier and less expensive to process and get paid than via credit card.

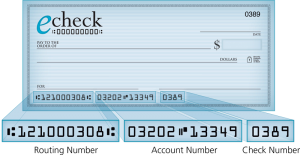

About Electronic Checks

Gain Peace of Mind with Check Guarantee

Our check guarantee products reduces risks associated with accepting bad checks. Funding is guaranteed for approved checks, and the money is deposited electronically into your account within 2-3 days

Protect Your Business & Save Time and Money

What is ACH Processing?

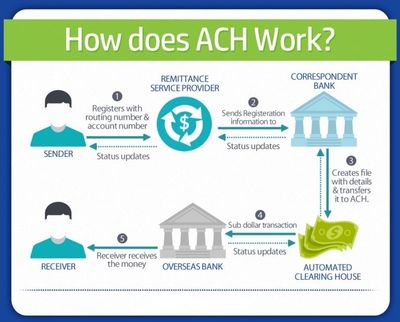

For a truly successful online store, your business must offer your customers as many payment options as possible. Even with the most advanced encryption and safeguards, some consumers don’t feel comfortable providing their credit card information to an online retailer. Fortunately, electronic payments can be made from customers’ checking accounts and deposited directly into the merchant’s bank account. The Automated Clearing House or ACH network enables this to happen, safely and seamlessly.

ACH & Electronic Check Processing Products

Virtual Check

Point of Sale Check Conversion

Point of Sale Check Conversion

Make debits a one-time charge or set up authorized ACH debit as recurring payments. Enter check information electronically, eliminating a trip to the bank.

- Funds deposited promptly, lower processing costs than credit cards

- Convenient 24-hour access to online reporting

- Automated recurring billing at no extra charge

- Easy to implement—no installation or upgrade required

Point of Sale Check Conversion

Point of Sale Check Conversion

Point of Sale Check Conversion

Using a check reader or imager connected to a credit card terminal, merchants can process and deposit business and consumer checks at the point of sale.

- Increase sales with this additional payment option

- Eliminate bad checks for security and peace of mind

- Faster availability of funds

- Eliminate NSF, check handling labor and other banking fees

Check 21

Point of Sale Check Conversion

Check 21

Accept all types of checks drawn on U.S. banks—personal, business, government, travelers, cashiers, and certified checks, as well as equity lines of credit and money orders.

- Fast electronic deposits of funds in 2-3 business days

- Payment made directly to your bank account

- Avoid ACH restrictions

- Eliminate bad checks

About ACH Processing

How Does the ACH Network Work?

The Automated Clearing House (ACH) is regulated by the National Automated Clearing House Association (NACHA). This is a batch processing system that is responsible for all electronic funds that are transferred by parties within the U.S. To be able to accept an ACH payment, a business must sign up for an ACH account with a payment processor. This could a bank where the company has their account, a company that processes credit card payments for the business or an accounting software service provider. There are many companies today that offer ACH payment services. Costs for the transaction will vary depending on the size of your business (how many payments you need to process) and the provider. The cost is typically lower than for credit card processing. For an online sale, after the customer selects an electronic check for the payment option, they’ll enter in their bank routing and checking account numbers. The merchant’s payment gateway will send the information, encrypted, to an electronic check acceptance service that verifies the customer information and evaluates the risk of that transaction. Databases are used, along with fraud prevention tools. The transaction is either approved or declined. Once approved, funds are automatically withdrawn from the customer’s account and transferred to the merchant’s account

What Can ACH Be Used For?

ACH is used for a wide variety of electronic fund transfers, such as person-to-person payments from online sales, business-to-business purchases, direct deposits from government programs and employers, bill payments and external funds transfers between banks. Third-party applications like Venmo and PayPal use ACH transfers.

How Do ACH Transfers Compare to Wire Transfers?

The main advantage of an ACH transfer over a wire transfer is cost. While a U.S. wire transfer costs approximately $20 to $30, an ACH transfer is usually only a few dollars. Because of this, wire transfers are used for larger payments and ACH payments are used for everything else. Previously, a wire transfer has been faster than ACH. However, the NACHA put a new rule in place in September of 2016 that moves ACH network processing towards three times every day instead of one. Same-day delivery of most ACH payments may be possible as early as March 2018.

Advantages and Benefits of Using ACH Payments

For merchants, ACH payment processing benefits include improved control over payments, better safeguarding against fraud and greater speed in accessing funds. Payments are typically processed within 1 to 2 business days, and sometimes the same day. This means that items can ship faster for quicker turnaround and improved customer satisfaction.

There are several advantages for consumers as well, such as more secure transactions and less likelihood of their personal information being stolen. Because of the faster processing, they’ll also get their purchases more quickly.

Request More Information

Interchange Plus Merchant Services

Hours

Open today | 09:00 am – 05:00 pm |

Copyright © 2023 Interchange Plus Merchant Services - All Rights Reserved.